vermont income tax payment

Freedom and Unity Live Common Services. Pay Estimated Income Tax Online.

In 151 Extension Of Time To File Vt Individual Income Tax Return

Vermont income tax rate.

/cloudfront-us-east-1.images.arcpublishing.com/gray/WLAG4ZHFR5GGJLZ5LUNEEVCDSU.jpg)

. Vermont has four tax brackets for the 2021 tax year which is a change from previous years when there were five brackets. Taxable income from your federal income tax return found on Form 1040. Payment vouchers are provided to accompany.

To pay the Vermont Use tax record your taxable purchases and submit your payment when filing your Form IN-111 Vermont Income Tax Return. The Vermont income tax has four tax brackets with a maximum marginal income tax of 875 as of 2022. 133 State Street 1st Floor.

If you do not file a Vermont Income tax form. IN-111 IN-112 IN-113 IN-116 HS-122 RCC-146 HI-144. Form FIT-160 is a Vermont Corporate Income Tax form.

Every case is unique and your payment plan will be based on a variety of factors specific to you and your situation. Property Tax Bill Overview. We last updated Vermont Form FIT-160 from the Department of Taxes in April 2022.

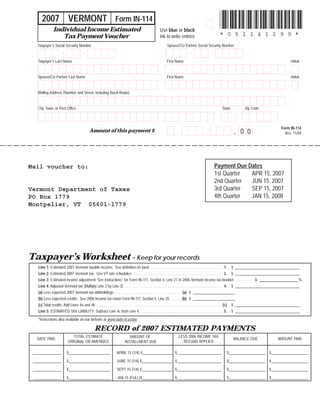

The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail. Fillable Online Tax Vermont. Individual Income Estimated Tax Payment Voucher Form IN-114 Vermont Department of Taxes DEPT USE ONLY 2021 Form IN-114 211141100 Vermont Individual Income Estimated 2 1 1.

Adjusted gross income and. Paying 50 of your FICA taxes is standard but self-employed workers have to pay. Freedom and Unity Live Common Services.

Rates range from 335 to. Vermont Income Taxes. Register or Renew a.

Business Start-Up Guide Step-by-step. This booklet includes forms and instructions for. Detailed Vermont state income tax rates and brackets are available on this page.

To file your Vermont Income Tax Return you will need to enter your. Payment vouchers are provided to accompany. Income Tax Payment Voucher.

When finished click the Continue button. Vermont Department of Taxes. We last updated Vermont Form CO-422 from the Department of Taxes in April 2022.

The Vermont income tax has four tax brackets with a maximum marginal income tax of 875 as of 2022. Form CO-422 is a Vermont Corporate Income Tax form. Register or Renew a Vehicle.

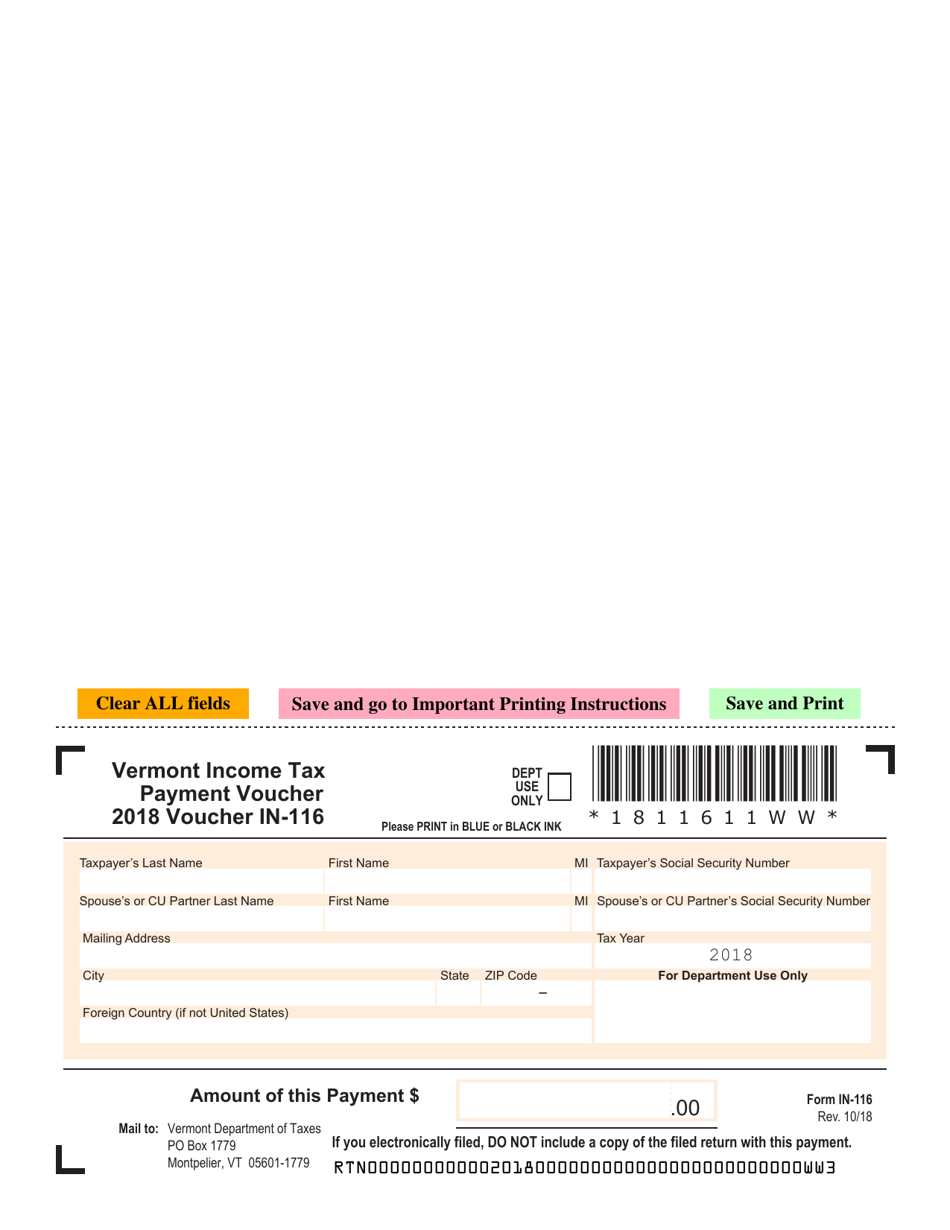

34 rows 2021 Vermont Income Tax Return Booklet. Income Tax Payment Voucher Form IN-116 Vermont Department of Taxes 211161100 DEPT USE ONLY 2021 Form IN-116 Vermont Income Tax Payment Voucher 2 1 1 1 6 1 1 0 0. The Vermont Department of Taxes offers several eServices for individual taxpayers and businesses through myVTax the departments online portal.

Pay Estimated Income Tax by Voucher. Income Tax Payment Voucher Form IN-116 Vermont Department of Taxes 211161100 DEPT USE ONLY 2021 Form IN-116 Vermont Income Tax Payment Voucher 2 1 1 1 6 1 1 0 0. Use myVTax the departments online portal to electronically pay your Estimated Income Tax.

Use myVTax the departments online portal to electronically pay personal income tax estimated tax and business taxes. Please contact us so that we can help you find a plan that works for you. You may submit all forms schedules and payments by personal check cashiers check or money order in person to.

Vermont State Tax Software Preparation And E File On Freetaxusa

Vermont Income Tax Vt State Tax Calculator Community Tax

Understanding Your Property Tax Bill Department Of Taxes

1098 T Tax Information W 9s Form Bursar S Office Virginia Tech

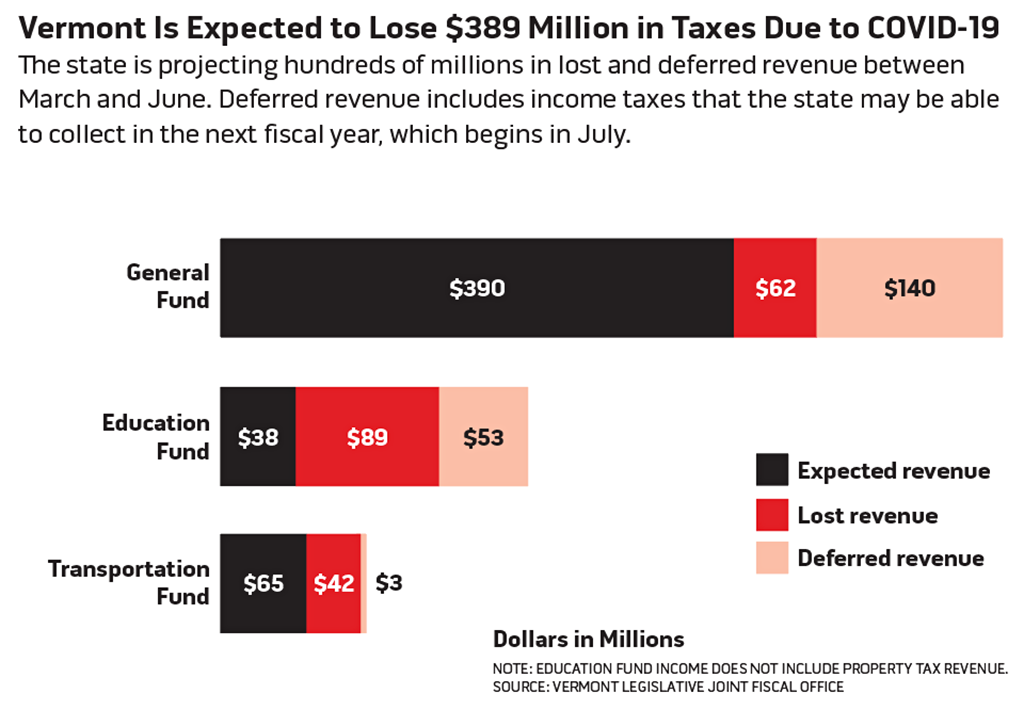

Downgraded Coronavirus Is Ravaging Vermont S State Budget Politics Seven Days Vermont S Independent Voice

Vt Form In 116 Download Fillable Pdf Or Fill Online Income Tax Payment Voucher 2018 Vermont Templateroller

Vermont Salary Example For 25 000 00 In 2023 Icalcula

Vermont S Effective Income Tax Rate Dropped In 2010 Public Assets Institute

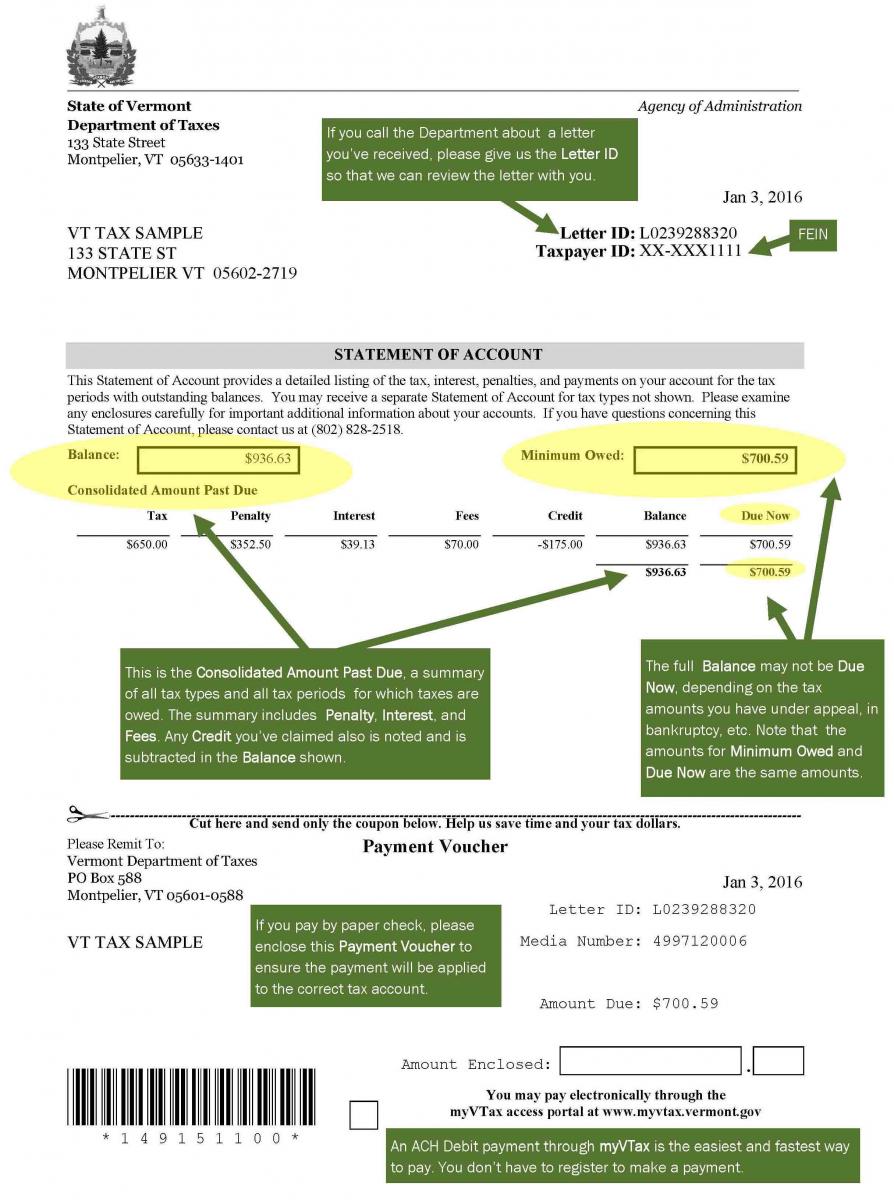

Your Tax Bill Department Of Taxes

File Vermont Income Taxes Get A Fast Tax Refund E File Com

New Look For Vermont Property Tax Bills Davis Hodgdon Cpas

Vermont State House Revenue And Revenue Options Taxes 7 29 2021 Youtube

Government Of Vermont Wikipedia

Fillable Online State Vt Vermont Use Tax Return State Of Vermont State Vt Fax Email Print Pdffiller

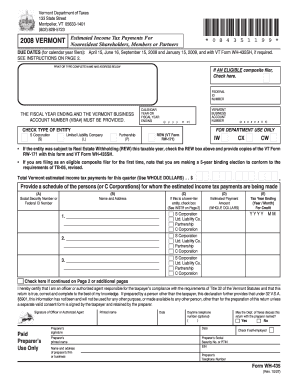

Fillable Online Tax Vermont Vermont Department Of Taxes 133 State Street Montpelier Vt 05633 1401 802 828 5723 2008 Vermont Estimated Income Tax Payments For Nonresident Shareholders Members Or Partners 084351199 0 8 4 3 5 1 1 9 9 If An

50 000 More Vermont Returns Expected By Wednesday Tax Deadline Vtdigger

Vermont Income Tax Calculator Smartasset

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

Personal Income Tax Blows Past Projections By Over 117 Million In April Vermont Business Magazine